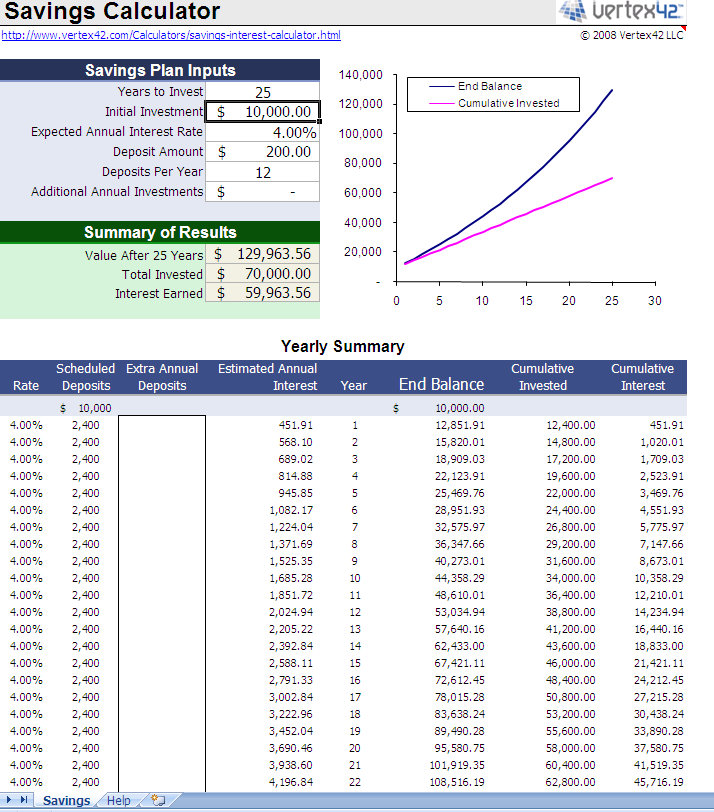

Compare total payments to interest earned. The idea behind this financial model was to make something simple enough that anyone can use it, but also provide enough dynamic features so that a wide range of things can be tested against. Description Estimate the future value of your retirement savings, based on a starting balance, expected interest rate, and annual investments. Whether youre organizing the business cash flow or planning your households. It may even help you finally enjoy budgeting Fill it your Simple Personal Finance Budget Planner every month and you will see the changes like I. I hope it entices you to make the leap into becoming your own financial CFO and help calm your financial chaos. There is a summary chart that displays your on-going cash position after taxes that may be useful so you can see what kind of savings you will have over the course of the next 60 months as well as the expected annual savings assuming your cash in and cash out match the assumptions entered. Budget management is an essential and integral part of day-to-day living. This Simple Finance Planner is an easy & gentle introduction into the world of finance. This was quite difficult to make work in a dynamic way, but it does. This budget Excel template compares project and actual income and projected and actual expenses. Excel does the math so you can concentrate on your finances. With a personal budget template, budget management is so easy. One of the more advanced features of the logic here is dynamically taking out the old rent/mortgage you were paying and replacing it with the new mortgage. Enter your age, salary, savings, and investment return information, as well as desired retirement age and income, and the retirement planning template will calculate and chart the required earnings and savings each year to achieve your goals. Streamline how you budget your income each month with this comprehensive budgeting template. Ensure that youre saving enough money to live comfortably in retirement by creating a comprehensive plan, estimating your daily needs and expenses, and. Based on that, the model will calculate your expected savings and test that against how much you need to make a down payment and still meet your cash reserve criteria.Īll you have to do in this model is change all the light yellow cells to meet your specific situation and it will tell you the month you should be able to buy a new house as well as how much cash flow you will have coming in per month before and after the purchase. You can adjust these on a monthly basis over a forward 60-month period. The key assumptions are gross monthly income, monthly taxes (federal/state/city), and monthly living expenses. this personal finance template should make it easier to see potential timelines and requirements that must be met. This is part of the personal finance bundle (7th category down here ).

#Savings planner excel download#

The template will be immediately available for download after purchase. This spreadsheet not only has detailed categories to plan spending, income, and savings across the year but also graphs to show breakdowns and progress.

0 kommentar(er)

0 kommentar(er)